The Best Places in Mexico for Investors: 2025 Real Estate Guide for Canadians

Thinking about investing in real estate abroad? For Canadians, Mexico offers some of the best places for investors looking to generate consistent rental income or long-term appreciation.

Whether your goal is to buy a vacation property, diversify your portfolio, or generate cash flow through Airbnb, Mexico is worth considering.

In this article, we’ll explore the top 5 investment destinations in Mexico in 2025, supported by real data on ROI, occupancy rates, and appreciation potential.

Plus, we’ll cover how foreign buyers — including Canadians — can legally purchase property through a fideicomiso.

👉 Ready to explore your buying options? Download our free property buying guide for Canadians

Why Mexico Attracts Canadian Real Estate Investors

From strong tourism demand to affordable entry points, Mexico is a smart choice for Canadians priced out of their local markets. Some of the key reasons include:

- High returns from short-term vacation rentals in tourist hotspots

- Lower purchase prices than in Toronto, Vancouver, or Montreal

- Proximity to Canada, with direct flights year-round

- Growing infrastructure, including the Tren Maya and new international airports

- A vibrant lifestyle that appeals to snowbirds, retirees, and digital nomads

The Best Places in Mexico for Investors in 2025

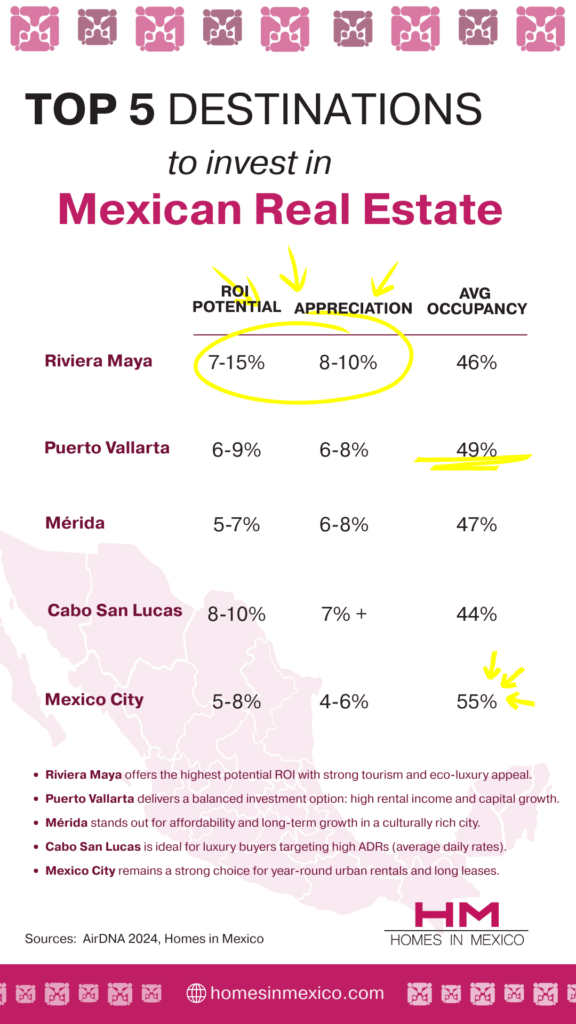

Here’s a data-driven look at the top 5 real estate markets in Mexico for investors this year:

| Destination | ROI Potential | Appreciation | Avg. 2024 Occupancy | Ideal Investor Profile |

|---|---|---|---|---|

| Riviera Maya | 7–15% | 8–10% | ~46% | Vacation rental-focused, eco-luxury buyers |

| Puerto Vallarta | 6–9% | 6–8% | ~49% | Balanced affordability + tourism appeal |

| Mérida | 5–7% | 6–8% | ~47% | Long-term investors seeking stable growth |

| Cabo San Lucas | 8–10% | 7%+ | ~44% | High-end luxury investors |

| Mexico City | 5–8% | 4–6% | ~55% | Urban investors targeting year-round demand |

Sources: AirDNA 2024 Regional Reports, Homes in Mexico Market Insights

Highlights:

- Riviera Maya offers the highest potential ROI with strong tourism and eco-luxury appeal.

- Puerto Vallarta delivers a balanced investment option: high rental income and capital growth.

- Mérida stands out for affordability and long-term growth in a culturally rich city.

- Cabo San Lucas is ideal for luxury buyers targeting high ADRs (average daily rates).

- Mexico City remains a strong choice for year-round urban rentals and long leases.

How Foreigners Can Buy Property in Mexico: Understanding the Fideicomiso

Foreigners, including Canadians, cannot directly own property within the Restricted Zone, that is, within 50 km of the coast or 100 km of a border.

However, there is a fully legal solution: the fideicomiso.

A fideicomiso is a bank trust that allows foreign nationals to buy and fully control property in Mexico’s restricted areas. Here’s how it works:

- A Mexican bank holds the title in trust, but you are the sole beneficiary.

- You can rent, sell, remodel, inherit, or live in the property just like any owner.

- The trust is valid for 50 years, renewable indefinitely.

- Annual trust maintenance costs are typically $500–$1,000 USD.

👉🏻 Read our full article on the fideicomiso process here

What Kind of Returns Can You Expect?

Your investment returns will depend on your strategy: short-term vacation rental, long-term lease, or future resale. Here’s what current occupancy data tells us:

- Mexico City: ~55% average occupancy (year-round demand from professionals and digital nomads)

- Puerto Vallarta: ~49% (strong seasonal and repeat tourism market)

- Mérida: ~47% (stable demand, growing infrastructure)

- Riviera Maya: ~46% (high seasonality, premium Airbnb potential)

- Cabo San Lucas: ~44% (luxury travel market with high nightly rates)

Data Source: AirDNA, 2024

High occupancy rates (even at ~45–55%) translate into solid returns, especially when paired with professional management and smart pricing strategies.

Key Considerations Before Investing

Before diving in, here are a few important factors Canadian investors should consider:

- Will you manage the property yourself or hire a local team?

- Do you plan to rent short-term (Airbnb) or long-term?

- Have you consulted with tax professionals in both Canada and Mexico?

- Are you ready to navigate currency fluctuations and cross-border financing?

Fortunately, working with experienced agents and legal advisors (like those at Homes in Mexico) can make the process smooth and secure.

Final Thoughts: Why These Are the Best Places in Mexico for Investors

Whether you’re aiming for short-term income or long-term capital growth, Mexico offers unmatched opportunities. Each of the destinations listed above brings a unique mix of ROI potential, lifestyle, and growing demand. All within reach of Canadian investors.

👉 Want a full breakdown of how to buy property in Mexico as a Canadian?

Download our free buying guide here

Thankfulness to my father who shared with me concerning this

website, this website is in fact remarkable.